Israel announced Saturday that the latest remains handed over by Hamas via the Red Cross were that of a deceased hostage.

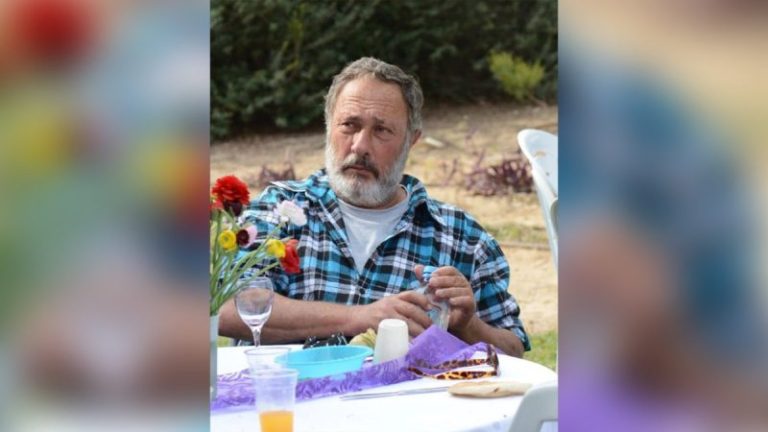

The Israel Defense Forces (IDF) identified the deceased hostage as Eliyahu Margalit, known by many as ‘Churchill,’ who was murdered during the Oct. 7, 2023, attacks. It also underscored that ‘Hamas is required to fulfill its part of the agreement and make the necessary efforts to return all the hostages to their families and to a dignified burial.’

Israel said Margalit was killed at the horse stables in Kibbutz Nir Oz and that his body was then taken into Gaza, where it was held for more than two years. The IDF initially confirmed Margalit’s death in December 2023.

Margalit’s daughter, Nili Margalit, was also taken hostage but was released during the brief November 2023 ceasefire. He leaves behind a wife, three children and grandchildren.

‘The government of Israel shares in the deep sorrow of the Margalit family and all the families of the fallen abductees,’ Israeli Prime Minister Benjamin Netanyahu’s office said in a statement. ‘The government and the entire Israeli Public Security Bureau are determined, committed and working tirelessly to return all of our fallen abductees for a proper burial in their country.’

Margalit’s loved ones said he went to feed his beloved horses early in the morning on Oct. 7 and that the horses were taken along with him, according to The Times of Israel. The outlet added that Margalit was responsible for the kibbutz’s cattle for many years.

‘Our beloved Eli has returned home, 742 days after he was murdered and kidnapped from Kibbutz Nir Oz. We thank the people of Israel and the Hostage Families Forum for their support in the long struggle for his return, and promise that we will not stop or rest until the last of the hostages is returned for burial in Israel,’ the family said in a statement, according to The Times of Israel.

The Hostages and Missing Families Forum, which was established in the wake of the Oct. 7 massacre, expressed condolences to Margalit’s family.

‘The families of the hostages and the released embrace the family of Eliyahu ‘Churchill’ Margalit at this difficult time, following the return of their beloved Eliyahu z’l to Israel last night for a proper burial,’ the forum wrote. ‘Alongside the grief and the understanding that their hearts will never be whole again, Eliyahu’s return brings some measure of solace to a family that has lived in unbearable uncertainty and doubt for over two years. We will not rest until all 18 hostages are brought home.’

The forum noted that Margalit was ‘a cowboy at heart’ and was linked to an organization known as ‘Riders of the South,’ which has been bringing horseback riding enthusiasts together for more than 50 years.

Margalit is the 10th deceased hostage to be returned to Israel, while the remains of 18 others are still in Gaza. Two of the deceased hostages whose bodies have not been returned are Itay Chen, 19, and Omer Neutra, 21, both of whom are U.S. citizens.