A new feature on Elon Musk’s X is exposing the truth behind social media accounts across the political spectrum, with account owners apparently misleading followers about where they are posting from.

The new feature allows all X users to inspect where a given account is based, usually listing a country or region. Many popular accounts posing as American ‘patriots’ or ‘constitutionalists’ have been exposed as being run from foreign countries since the update rolled out on Friday.

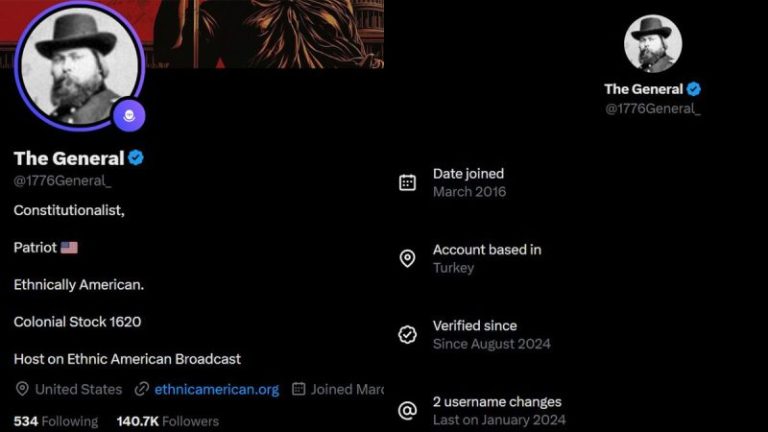

One account with the handle ‘@1776General_’ boasts over 140,000 followers and has a user biography describing the owner as a ‘constitutionalist, patriot and ethnically American.’ The biography claims the account is based in the U.S., but X’s new feature reveals it is actually based in Turkey.

‘I work in international business. I’m currently working in Turkey on a contract,’ the owner of the account posted after the new feature was released.

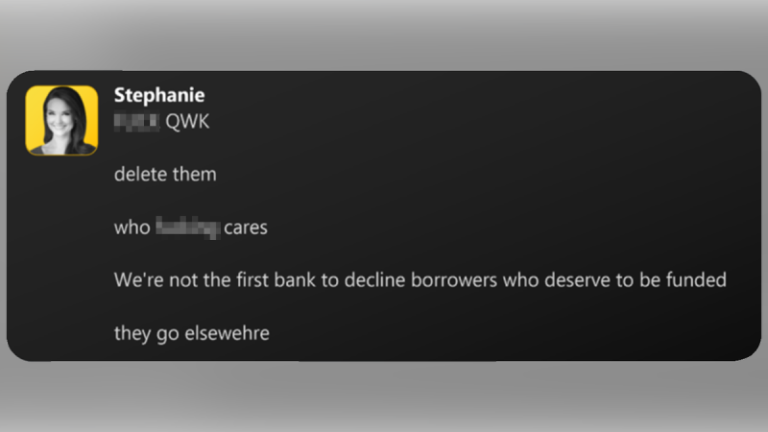

Another account, ‘@AmericanVoice__’ had over 200,000 followers before the update rolled out. The new feature exposed that it was being run from South Asia, and the owners simply deleted the account.

X head of product Nikita Bier says the new feature should help X users sift out misinformation from their feeds.

‘When you read content on X, you should be able to verify its authenticity. This is critical for staying informed about important issues happening in the world. Part of this is showing new information in accounts, including the country an account is located in, among other things,’ Bier wrote.

The phenomenon is not limited to American politics, however. Many accounts claiming to have been reporting on alleged Israeli war crimes in Gaza also appear to be misleading users.

One user, Motasm A Dalloul, uses the handle ‘@AbujomaaGaza’ and claims to be a ‘Gaza-based journalist.’ His account has over 197,000 followers, but X says the owner is actually posting from Poland.

Dalloul has pushed back on claims that he is lying to his followers, however, posting a video on Saturday that appeared to show him on the ground in Gaza. Many users have argued about whether the video was digitally altered.

Another Palestinian-related account, the Quds News Network or @QudsNen, describes itself as the ‘largest independent Palestinian youth news network’ and has over 600,000 followers.

The account lists its location as ‘Palestine,’ but X says the account is actually based out of Egypt – unlike other accounts that X does list as being based in ‘Palestine,’ such as American-Palestinian journalist Mariam Barghouti.

A similar account under the name Times of Gaza/@Timesofgaza has nearly one million followers. It claims to provide the ‘latest news updates and top stories from occupied Palestine.’ The account is based in ‘East Asia and the Pacific,’ according to X.

X representatives have said its new feature could be partially spoofed by using a VPN to mask a user’s true location. In such cases where a VPN was detected, X added a warning next to the listed location.